Already signed up for eStatements? You can easily send copies to someone you trust, like your accountant, a family member, or Attorney-in-Fact—without mailing paper copies. Additional Recipients will receive password-protected eStatements only and will not have access to Online or Mobile Banking.

If you’re using Online Banking:

Step 1: Select the Account

- From your Dashboard, click or tap the account you’d like to enroll additional recipients in.

Step 2: On the right side of the screen, click the Settings card.

- Scroll to the bottom of the screen; in the Documents card, select Advanced Settings.

Step 3:

- At the top of the screen, select the Additional Recipients tab.

Click the Add Additional Recipients button.

Step 4: Add Recipient Information

- Enter the recipient’s Email Address, create a Username, and set an Access PIN, then, click Save.

- If you’d like to add more recipients: click Add Additional Recipients.

Step 5: Assign Documents to Additional Recipients.

- Next to edit, click Assign Documents

- Select the account(s) you want to share with the additional recipient and click Save Settings.

Step 6: The eStatement Service Agreement will appear on your screen.

- Click I Agree to show you have read the eStatement Service Agreement.

- Add More or Manage Access

- Repeat the steps above to add more recipients. You can edit or remove access at any time.

If you’re using Mobile Banking:

Step 1: Select the Account

- From your Dashboard, tap the account you’d like to enroll additional recipients in.

Step 2: Tap on Settings.

- Next to electronic statements, select Advanced Settings.

Step 3: You will be directed to the Documents window.

- At the top of the screen, select the Additional Recipients tab.

- Click the Add Additional Recipients button.

Step 4: Add Recipient Information

- Enter the recipient’s Email Address, create a Username, and set an Access PIN, then, click Save.

- If you’d like to add more recipients: click Add Additional Recipients.

Step 5: Assign Documents

- Next to edit, click Assign Documents

- Select the account(s) you want to share with the additional recipient and click Save Settings.

Step 6: The eStatement Service Agreement will appear on your screen.

- Click I Agree to show you have read the eStatement Service Agreement.

- Add More or Manage Access

- Repeat the steps above to add more recipients. You can edit or remove access at any time.

Important: Credentials must be shared with the recipient and will expire every 6 months for security purposes.

Additional Recipients – Frequently Asked Questions

What can an Additional Recipient access?

Additional Recipients will be able to view eStatements, check images, and tax notices for the accounts you’ve shared with them. They will not have access to Online or Mobile Banking features such as transfers, Bill Pay or adding other recipients.

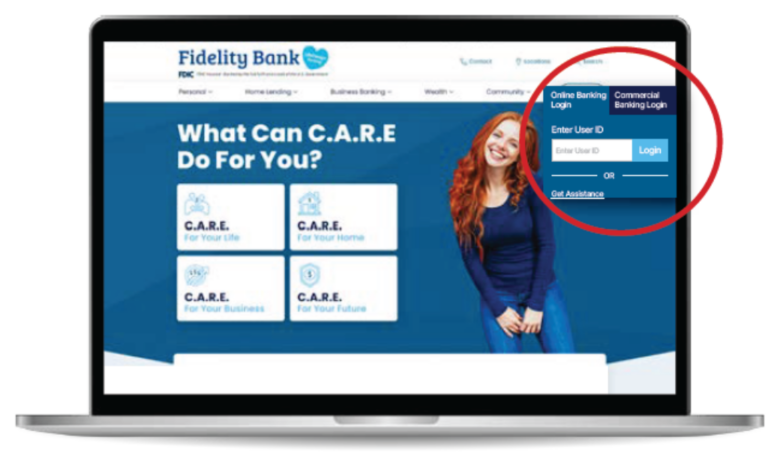

How will the Additional Recipient access the documents?

You’ll set up the recipient with their email address, a Username, and an Access PIN. When new eStatements or notices are available, the recipient will receive an email with a secure link. They’ll use the credentials you created to log in and view the documents. For added security, these credentials will expire every 6 months.

Can I revoke or update Additional Recipient’s access?

Yes. You can edit or delete recipient access at any time by signing in through Online or Mobile Banking. Access will also automatically expire every 6 months unless updated.

Is there a fee to add an Additional Recipient?

No. Fidelity Bank provides this service free of charge to help you securely share your account documents.