Budgeting 101

Developing your budget process is vital for your financial well-being. In order to determine effective monthly budget plans that can help you reach your financial goals, it’s crucial to have a clear idea of what budgeting is and how it works.

What Is Budgeting?

Budgeting is a plan that allows you to balance your finances over time. Budgets act as a financial roadmap, helping you spend your money responsibly, pay down debts, build up savings, and improve the overall quality of your financial health.

How Budgeting Works

In the simplest form, budgets work by subtracting your expenses from your income over a specific period. The overall goal of a budget is to plan out where your money will go to ensure you end up with a surplus at the end of the period. By putting time and effort into your budgeting process, you’ll be able to determine your spending habits and adjust them so that you can put more money toward your savings goals.

How To Create Your First Budget

Budget planning can be intimidating but less challenging than most people think. With these budgeting tips, you can get started and begin to notice a difference in your bank account balance.

Choose a Budgeting Method

Before you start budgeting, you’ll need to decide which type of budgeting is best for your financial situation. There are several effective budgeting methods to choose from. Understanding the different approaches to budgeting will allow you to determine which one will be easiest to stick to. Some of the notable budgeting methods include:

- Zero-based budgeting: This budgeting strategy requires you to predict your monthly expenses and give each dollar a specific purpose. At the end of the month, you should be left with $0, but keep in mind that you will assign some money to savings. This method works well if you have excellent planning skills and can abide by strict rules.

- Envelope budgeting: The envelope system is an effective template for budget planning that deals with cash. For this method, you take several envelopes and label each with a different spending category, such as groceries, eating out, and variable expenses. You then divide the total amount of cash you will spend over the next month between these envelopes. As the month progresses, you’ll have to balance your spending in each category so you don’t run out of cash in that area.

- 50/30/20 budgeting: This budget involves breaking down your expenses into three categories that add up to 100 percent. A popular starting point is allotting 50% of your income to necessary expenses, 30% to discretionary income, and the remaining 20% to savings or debt payments. You can change the percentages to fit your financial situation.

- Budgeting software: Using budgeting apps or software is an excellent option to help track your spending. Some budgeting applications allow you to connect your bank accounts, as well as credit and debit cards so that the software can track your spending automatically. Budgeting software can help you understand your spending habits with visual graphs and graphics.

Set Realistic Spending Limits According To Your Lifestyle

It’s easy to sit down and plan a budget with stringent spending limits in mind to maximize your savings or pay down your debt. However, setting realistic spending limits that align with your lifestyle is essential. Creating a plan that is too rigid may result in frustration and giving up on the budget altogether.

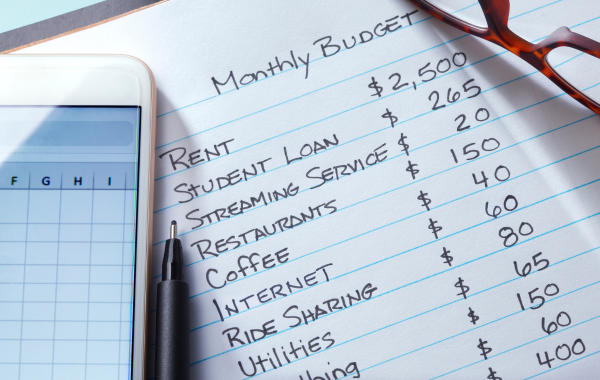

To create a realistic spending plan, you’ll want to first determine your average monthly income. Determine how much you’ll need to pay each month for fixed expenses, such as rent and utilities. Then, consider any debts you’ll need to pay down each month, such as mortgages or credit cards. With the remaining amount of money, you can determine your financial goals.

Track and Adjusting Your Budget

Don’t expect to have the perfect budget right away. After tracking your spending for a few months, you can identify areas where you can save money. If budgeting software automatically tracks your spending, this can be easy to spot. However, if you’re using bank statements or online mobile and text banking to determine your spending habits, it may be time-consuming, but it will still be helpful.

For example, you might be spending a lot more on nights out than you realized, or the monthly total on coffee might add up to a much higher sum than you expected. Tracking your spending will provide fresh insights that you can use to improve your budget. Don’t be afraid to readjust your budget the next month to free up money by making a few changes.

Build an Emergency Fund

Savings goals are essential aspects of budgeting that allow you to put money aside so you can afford that Caribbean vacation or upgrade your kitchen. However, building an emergency fund is just as important. Setting money aside for unexpected expenses will ease a lot of stress when emergencies occur because you won’t need to worry about rerouting money away from other areas of your budget. You also won’t need to withdraw from your savings, which may be especially important if you’re depositing into a savings CD.